Ricky's Roofing Insights

Discover expert tips and trends in roofing and home improvement.

Is Whole Life Insurance the Secret Ingredient to Your Financial Recipe?

Unlock the hidden benefits of whole life insurance and discover how it can elevate your financial strategy today!

Understanding Whole Life Insurance: A Key Component of Your Financial Strategy

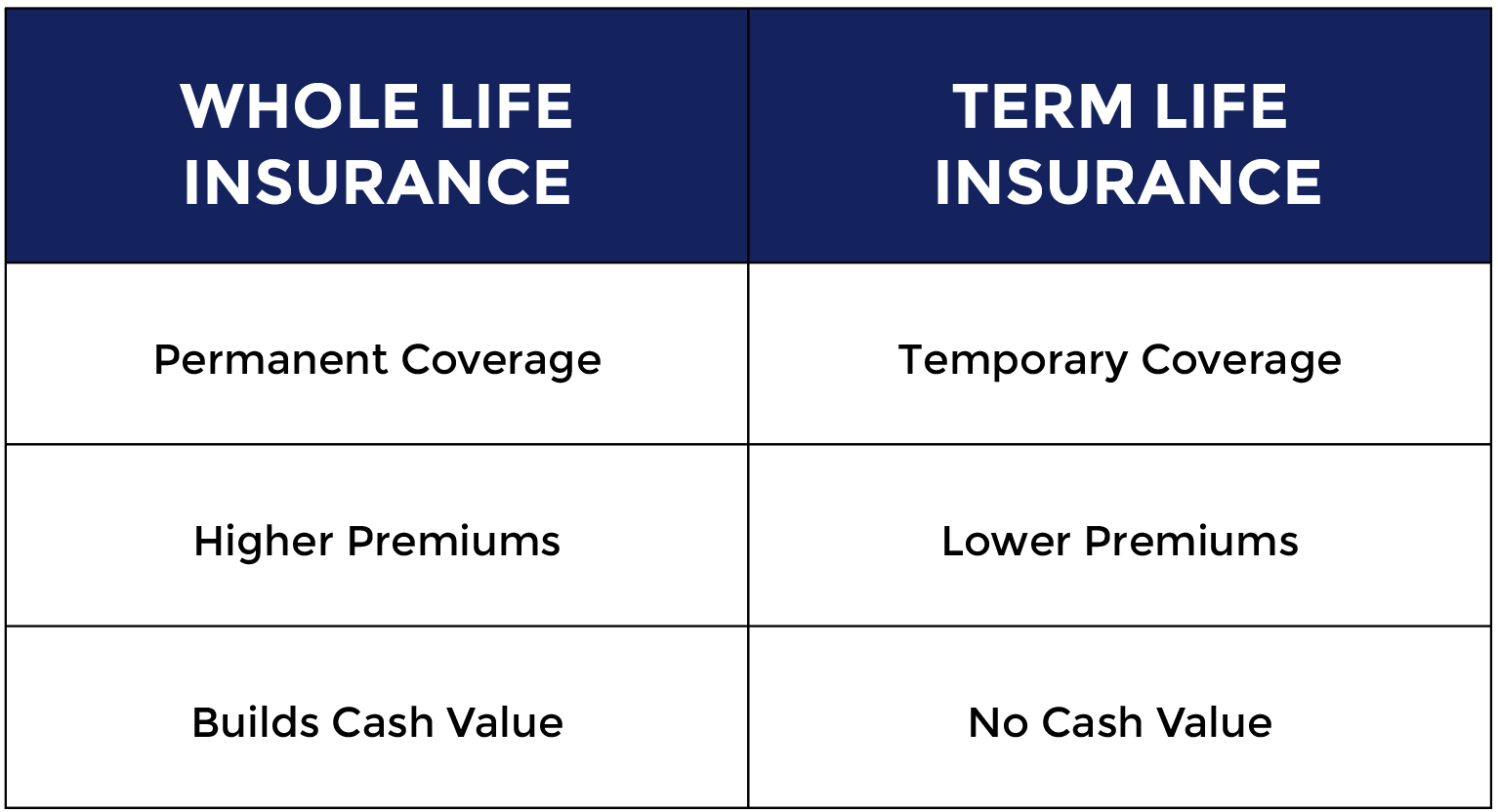

Whole life insurance is more than just a policy; it is a financial instrument that can play a crucial role in your overall financial strategy. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifetime protection and accumulates cash value over time. This dual purpose allows policyholders not just to safeguard their loved ones financially but also to leverage the policy for potential loans or even as a retirement supplement. For more detailed information about the benefits of whole life insurance, check out Investopedia.

Integrating whole life insurance into your financial strategy can offer several significant advantages. Firstly, the policy's cash value grows at a guaranteed rate, providing a stable asset within your portfolio. Secondly, the death benefit is generally tax-free, making it an efficient way of transferring wealth. Additionally, because whole life insurance is designed to last a lifetime, it can be a strategic part of estate planning, ensuring that your beneficiaries receive the financial support they need. For further insights into whole life insurance and how it compares to other types, visit NerdWallet.

Is Whole Life Insurance Right for You? Exploring Its Benefits and Drawbacks

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. One of the main benefits of whole life insurance is its cash value component, which accumulates over time and can be borrowed against or withdrawn from. This feature can provide financial flexibility, making it a more appealing option compared to term life insurance. Additionally, whole life policies often come with a guaranteed death benefit, ensuring that your beneficiaries receive a reliable payout upon your passing. For more on the benefits, you can explore resources like Investopedia.

However, there are also drawbacks to consider when evaluating whether whole life insurance is right for you. One major concern is the cost; whole life premiums tend to be significantly higher than those for term life insurance, which may not fit within every budget. Furthermore, the return on the cash value can be lower compared to other investment vehicles, such as stocks or mutual funds. It's important to carefully weigh these drawbacks against the potential benefits and to assess your long-term financial goals. For a balanced perspective, check out this article from Forbes.

How Whole Life Insurance Can Enhance Your Financial Recipe: A Comprehensive Guide

Whole life insurance is not only a safety net for your family's financial future but can also serve as a powerful tool in your overall financial strategy. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection. One of the most compelling features of whole life insurance is how it accumulates cash value over time. This cash value grows at a guaranteed rate, providing a savings component that can be accessed for emergencies or funded for other financial goals. According to Investopedia, this aspect can significantly enhance your financial recipe by creating an additional asset that appreciates over time.

Incorporating whole life insurance into your financial portfolio means you are investing in both protection and wealth-building. As this policy builds cash value, you can borrow against it, potentially using these funds for key investments, such as a down payment on a house or educational expenses. Furthermore, the death benefit from a whole life policy is typically tax-free, making it an effective estate planning tool. It helps ensure that your loved ones are taken care of and that your financial legacy can be passed down without the burden of taxes. To understand more about leveraging life insurance for wealth building, check out NerdWallet.