Ricky's Roofing Insights

Discover expert tips and trends in roofing and home improvement.

Whole Life Insurance: A Lifelong Investment That Pays Off

Unlock the secrets of whole life insurance: discover how this lifelong investment can secure your financial future and must-know benefits!

Understanding Whole Life Insurance: How It Works and Why It Matters

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid. Unlike term life insurance, which only offers a payout if the policyholder passes away during the specified term, whole life insurance has a cash value component that accumulates over time. This cash value can be borrowed against or withdrawn, making it a versatile financial tool. Understanding how whole life insurance works is crucial, as it not only offers a death benefit to beneficiaries but also serves as a savings mechanism. For detailed insights into how it operates, you can read more at Investopedia.

Why does whole life insurance matter? It provides financial security for your loved ones and can also be a strategic component of your overall financial plan. The policy's cash value can grow at a guaranteed rate, offering a safe investment opportunity as well as a way to build wealth over time. Furthermore, whole life insurance can also serve as an effective estate planning tool, ensuring that your beneficiaries receive a tax-free death benefit. To learn more about the significance of whole life insurance in financial planning, check out this resource from Kiplinger.

The Long-Term Benefits of Whole Life Insurance: Is It Worth the Investment?

Whole life insurance offers several long-term benefits that can make it a worthwhile investment for individuals looking for financial security. One of the primary advantages is the guaranteed cash value accumulation. Over time, this cash value grows at a consistent rate, allowing policyholders to borrow against it or withdraw funds if needed. This feature can be particularly beneficial during retirement, providing an additional source of income. According to Investopedia, whole life policies also typically offer level premiums, meaning your payments won’t increase as you age, which can lead to significant savings over the long term.

Additionally, whole life insurance provides a death benefit that ensures your beneficiaries are financially protected in the event of your untimely passing. This can be an essential part of estate planning, helping to cover debts, funeral expenses, or even leaving a financial legacy. As noted by Forbes, the combination of the cash value growth and the guaranteed death benefit makes whole life an attractive option for those looking to build a solid financial foundation while ensuring peace of mind for their loved ones.

Whole Life Insurance vs. Term Life Insurance: Which is Right for You?

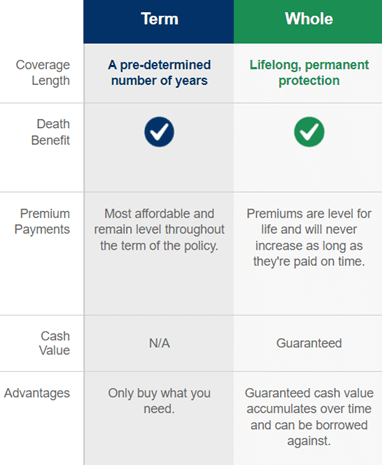

When considering life insurance, it's essential to understand the key differences between Whole Life Insurance and Term Life Insurance. Whole Life Insurance provides lifelong coverage and includes a cash value component that grows over time, making it a more permanent financial tool. On the other hand, Term Life Insurance offers coverage for a specified period, typically between 10 to 30 years, and is often more affordable. If you're looking for flexibility and investment potential, Whole Life may be the right choice for you. For an in-depth comparison, check out Investopedia.

Ultimately, choosing between Whole Life and Term Life Insurance depends on your financial goals, age, and family needs. For instance, if you're looking for lower premiums and a straightforward approach to coverage, Term Life Insurance might suit you better. However, if you desire lifelong protection with a cash value that you can borrow against in the future, Whole Life Insurance could be the ideal option. To explore more detailed information about these types of policies, visit NerdWallet.