Ricky's Roofing Insights

Discover expert tips and trends in roofing and home improvement.

Blockchain: The Plot Twist in the Future of Finance

Discover how blockchain is reshaping finance and uncover the twists that could revolutionize your financial future! Read more now!

Understanding Blockchain: How It Revolutionizes Financial Transactions

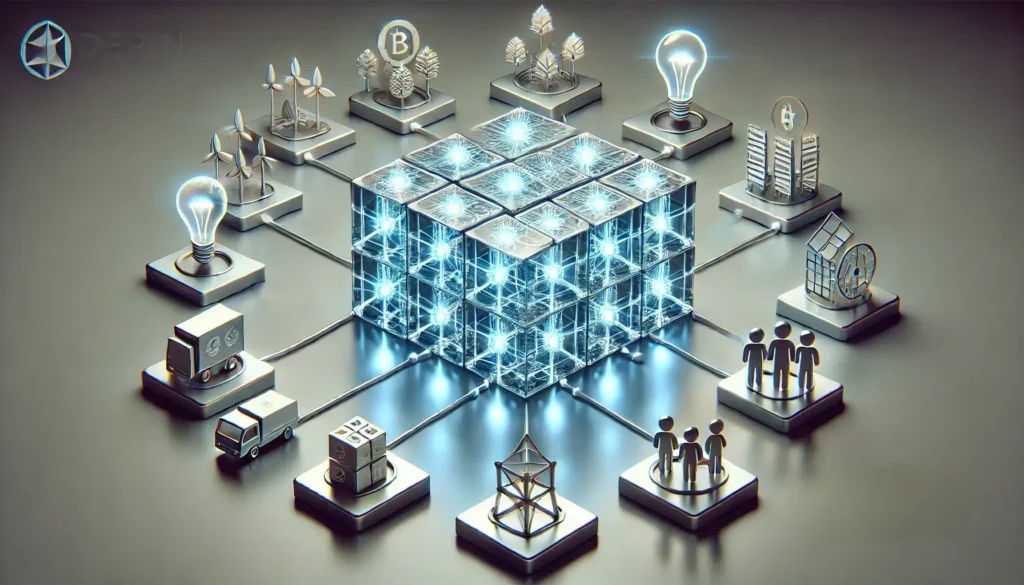

Understanding Blockchain is crucial for anyone interested in the future of finance. At its core, blockchain is a decentralized ledger technology that enables secure, transparent, and efficient transactions without the need for intermediaries. This revolutionary system is composed of a network of computers, or nodes, that validate and record transactions in real time. Each transaction is grouped into a block, which is then linked to the previous block, creating a chain of information that is nearly impossible to alter. This inherent security feature significantly reduces the risk of fraud and enhances the integrity of financial transactions.

The impact of blockchain on financial transactions is profound, as it introduces a new era of efficiency and accessibility. Traditional methods often involve multiple parties, leading to increased costs and processing times. However, with blockchain, transactions can occur directly between parties, cutting out the middlemen and streamlining the process. Moreover, blockchain technology enables real-time settlements, which enhances liquidity and allows for instantaneous access to funds. As more industries recognize the potential of blockchain, its role in revolutionizing the financial landscape becomes increasingly evident.

Is Blockchain the Key to Ensuring Transparency in Finance?

The advent of blockchain technology has sparked discussions about its potential to reshape various industries, with finance being at the forefront. By its very design, blockchain creates a decentralized ledger that records transactions transparently and immutably. This characteristic allows for enhanced transparency in finance, as all parties involved can access and verify the transaction history in real-time. Unlike traditional systems, where information is often siloed and opaque, blockchain democratizes access to data, minimizing the risk of fraud and error.

Moreover, the implementation of smart contracts on blockchain platforms further augments financial transparency. Smart contracts automate and enforce the terms of agreements, ensuring that all parties adhere to predefined conditions without intermediaries. This not only reduces operational costs but also fosters trust among participants. As more financial institutions explore the integration of blockchain, we may witness a significant shift towards more transparent financial practices that empower consumers and enhance regulatory compliance.

Top 5 Challenges Facing Blockchain Adoption in the Financial Sector

As the financial sector increasingly explores the potential of blockchain technology, several challenges hinder its widespread adoption. One of the main barriers is regulatory uncertainty. Financial institutions often face a patchwork of regulations across different jurisdictions, making it difficult to implement blockchain solutions that comply with both national and international laws. This ambiguity can lead to hesitation among financial entities to invest in blockchain, fearing future penalties or the need for costly adjustments to comply with new regulations.

Another significant challenge is interoperability. Many blockchain platforms operate in isolated silos, which creates compatibility issues when integrating with existing financial systems. To fully realize blockchain's benefits, such as increased efficiency and reduced costs, it is crucial for different blockchains to communicate effectively with each other and with traditional financial infrastructures. Overcoming these hurdles requires collaboration among various stakeholders, including technology providers and regulators, to establish industry standards.