Ricky's Roofing Insights

Discover expert tips and trends in roofing and home improvement.

Digital Wallet Integrations: Your Business's Secret Sauce for Seamless Transactions

Unlock seamless transactions for your business with digital wallet integrations—discover the secret sauce to boost sales and enhance customer experience!

Understanding Digital Wallet Integrations: How They Simplify Your Transactions

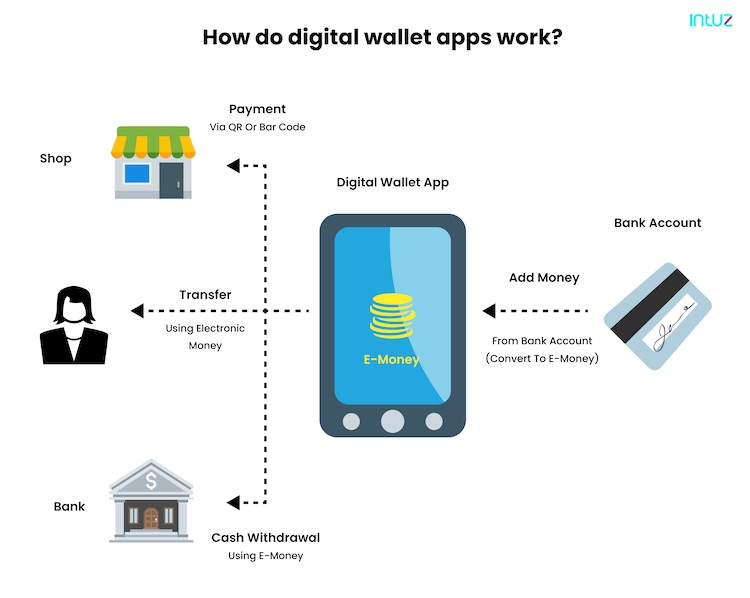

Understanding Digital Wallet Integrations is essential in today's fast-paced digital economy. These integrations allow users to store and manage their payment information securely in a virtual wallet, thereby simplifying the transaction process. Instead of fumbling through physical cards or entering lengthy details for each purchase, digital wallets streamline the procedure into a few quick taps or clicks. Whether you're buying groceries online or splitting a bill with friends, the convenience of having a digital wallet can significantly enhance user experience, making transactions more efficient than ever.

One of the key benefits of digital wallet integrations is that they often support multiple payment methods within a single interface. Users can link credit cards, debit cards, and even cryptocurrency accounts, making it easy to switch between payment options depending on their needs. Furthermore, as security is a top priority in financial transactions, digital wallets typically incorporate advanced technologies like encryption and two-factor authentication, ensuring that your sensitive information remains protected. In summary, adopting digital wallet integrations not only simplifies transactions but also promotes a secure and hassle-free payment experience for users.

Counter-Strike is a popular tactical first-person shooter game where teams of terrorists and counter-terrorists battle to complete objectives. Players can engage in various game modes, and many enthusiasts enjoy betting on matches. You can enhance your betting experience by using a betpanda promo code when placing your bets. The game's competitive nature and strategic depth have made it a staple in esports worldwide.

Top 5 Benefits of Integrating Digital Wallets into Your Business

Integrating digital wallets into your business can lead to significant benefits that enhance both customer experience and operational efficiency. One of the most notable advantages is the increased convenience for customers, as digital wallets streamline the payment process. Customers can complete transactions with just a few taps on their smartphones, eliminating the need for cash or credit cards. This ease of use often leads to higher conversion rates, as potential buyers face less friction during the checkout process.

Another major benefit is the enhanced security that digital wallets provide. Traditional payment methods may expose sensitive information, but digital wallets utilize encryption and tokenization to protect user data. This increased security not only builds trust with your customers but also significantly reduces the risk of fraud. Moreover, by integrating digital wallets, businesses can gain valuable customer insights through data analytics, allowing for targeted marketing strategies and personalized services that can drive customer loyalty.

Is Your Business Ready for Digital Wallets? Key Questions to Consider

As more consumers embrace digital wallets for their transactions, it's crucial to evaluate whether your business is fully prepared to integrate this technology. Start by asking yourself a few important questions:

- Do you understand the various types of digital wallets available, including mobile wallets like Apple Pay and Google Pay?

- Have you assessed your current payment processing system to ensure compatibility?

- Are your staff and customers educated on how to use digital wallets effectively?

Additionally, consider the security implications of adopting digital wallets. Cybersecurity should be a top priority as the risk of data breaches and fraud can increase with digital payment methods. Ask these key questions:

- What measures are in place to protect sensitive customer information?

- Have you trained your team to recognize and respond to potential security threats?

- Are you prepared to handle customer inquiries and issues related to digital wallet transactions?